.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C1360%2C1360&w=680&h=680)

Invoice OCR uses optical character recognition (OCR) technology to convert uneditable images or documents into machine-readable and editable data, reducing manual tasks and human errors.

Invoice OCR accuracy rate should be about 98-99%, and human supervision is still necessary.

Managing invoices and invoice payments can be overwhelming, with tremendous manual data entry and a mountain of papers.

However, with invoice OCR, you can speed up that data entry process and turn papers into an editable digital files directory.

This article will provide an overview of invoice OCR, including what it means, its benefits, best practices, and challenges.

Invoice OCR is a form of invoice automation technology that uses optical character recognition (OCR) to convert unstructured invoice data into machine-readable and structured data.

In simpler terms, it extracts data from scanned invoices, images of invoices, invoice PDF files, or even handwritten invoices and puts the data into editable digital files or into your preferred system or software.

🔎 Insight: Invoice automation technology market valued $2,286.3 million in 2021 and is predicted to reach $7,188.8 million by 2030.

Statrys Invoicing Software

Start using OCR to upload and save invoice details. Try how easy it is today!

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C1360%2C1360&w=680&h=680)

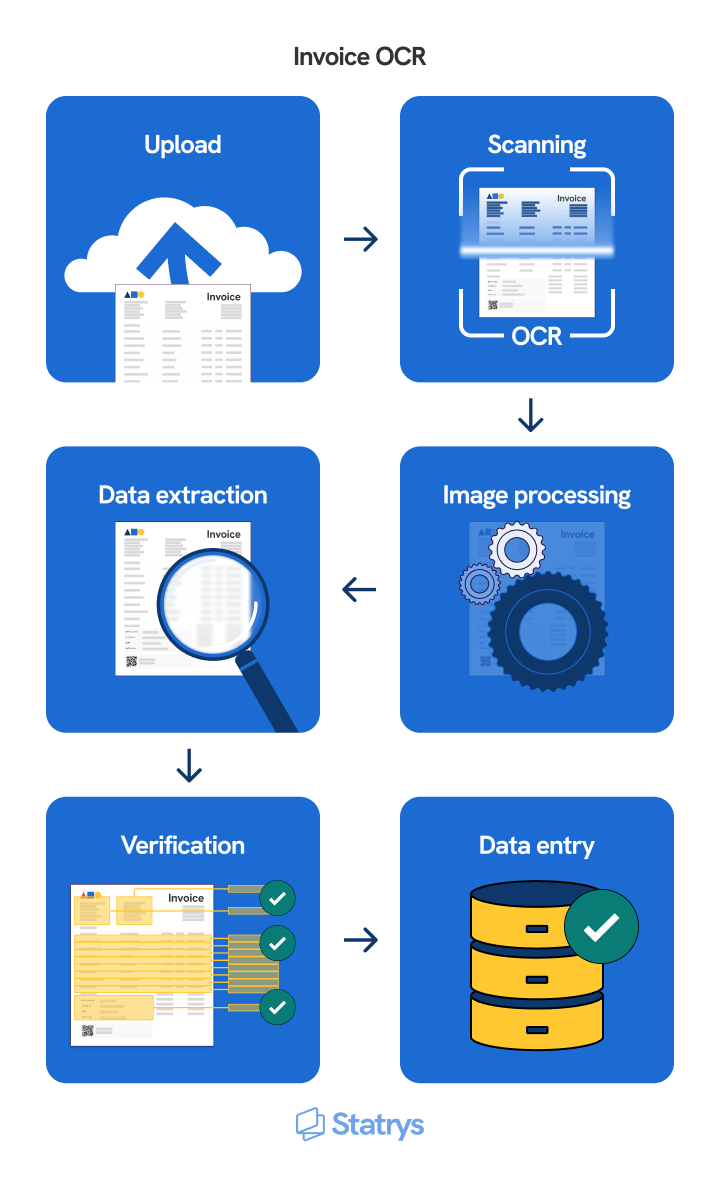

Optical character recognition (OCR) technology, also called "text recognition" technology, uses hardware and software to perform a series of steps, from acquiring images, processing, and extracting text to producing the output.

The process can be broken down into the following steps:

1. Scanning

You use a scanner to scan a physical invoice, or you take a picture of it and upload the file onto the system.

2. Image Processing

OCR software binarizes, removes noises, thins, and normalizes images. All these techniques are used to make the image as clear as possible and enable the system to differentiate characters from the background.

3. Data Extraction

The system then extracts data in the invoice image and matches the extracted text with its respective fields, such as the supplier's company name, purchase date, product summary, amount, etc.

4. Verification

Once the data is extracted, the OCR software will validate its accuracy by cross-referencing it with other data, such as the purchase order number or shipping address.

5. Data Entry

The OCR software puts extracted data into the user's preferred system, whether electronic files, databases, spreadsheets, ERP systems, accounting software, or CRM software. It can also put text into structured data that can be read electronically.

🔎 Tip: OCR technology is increasingly leveraging AI to enhance the process, referred to as Intelligent Character Recognition (ICR).

Now that we understand how OCR works, let’s compare OCR technology to traditional invoice processing.

| Feature | Invoice OCR | Traditional Invoice |

| Data Entry |

Invoice OCR automatically extracts data from defined fields such as invoice number, issue date, due date, etc, and puts them in a preferred system or software.

In contrast, traditional invoice processing requires manual effort to enter data from paper or PDF files into a system or software.

Invoice OCR uses encryption to prevent unauthorized access or modification.

Traditional invoice processing may not be encrypted, thus posing risks such as unauthorized access and modification

Invoice OCR can work with different software and platforms through APIs and connectors that are compatible with OCR’s metadata.

Traditional invoice processing can also work with other systems through file transfers and data imports, but it may not be as efficient or reliable as invoice OCR integration due to difficulty following different invoice formats.

Depending on the invoice formats and providers, OCR software can process an invoice within seconds or minutes.

On the other hand, traditional invoice processing takes longer as the volume increases, especially if there are discrepancies in the data. This can extend the processing time per invoice from 20 minutes to hours or even days.

Let's take a closer look at the benefit of making invoices digital.

Unlike humans, machines don't suffer from brain fatigue when dealing with numerous documents, resulting in human-error-free processing.

One of the most trusted OCRs, Google Cloud Platform’s Vision, has a 98.0% accuracy rate when tested with typed, scanned, and handwritten text. Several OCR’s tool accuracy is above 99.2% when processing only typed text.

Typical errors found in OCR are when the machine fails to recognize handwriting or misread non-standard font, like detecting number 0 as a letter O or number 2 as a letter z.

While reviewing the OCR results manually is necessary, it speeds up the process and reduces errors nonetheless.

Most digital software utilizes a secure cloud-based service to encrypt your data while it is stored and during transmission.

Goldman Sachs research estimates that small to medium-sized businesses spend an average of $16 - $22 per manual invoice processing. However, technology and automation can cut the costs by 60%-70% to just $6-$7.

Data entry can be tedious.

The average AP team is reportedly overwhelmed by repetitive data entry and invoice processing tasks, which consume 84% of their time.

On the other hand, implementing OCR automation may reduce invoice processing time by 60% and translate to more productivity.

To elaborate, automated invoice processing can take care of repetitive tasks and extract data from various sources simultaneously. The process is faster, thus enabling human workers to focus on more intricate aspects of their work, such as analyzing cash flow, maintaining vendor relationships, and ensuring compliance with financial regulations.

Consider digitizing your invoice for better storage. Paper invoices are more prone to loss, and searching through paper stacks is more time-consuming than searching within a secure digital database.

Going digital also saves space and reduces clutter.

OCR software is a great labour saving device but there are factors that come into play when considering implementing invoice OCR, including:

OCR is most useful when you handle large volumes of invoices. Let’s say hundreds or thousands. The higher the volume of invoices, the more benefits OCR technology can provide.

If you only deal with a few monthly invoices, the return on investment (ROI) of OCR may not be substantial.

Do you plan to scale? If so, consider integrating OCR along with other account automation tools.

Essentially, OCR helps increase invoice processing capacity without needing more staff.

For businesses with predictable invoice volumes and no priority on scaling, OCR still offers benefits. However, the ROI of OCR may not be as significant as those who plan to scale.

OCR involves upfront costs for software, hardware, training, and integration. The cost varies depending on the vendor and the features.

Assess the cost alongside potential benefits such as labour cost reduction, data accuracy improvement, and productivity increment.

If your priority is enhanced security, OCR software that securely encrypts, stores, and transmits your invoice data can be a good choice.

Depending on the industry, location, and type of invoice, a business may need to follow certain standards regarding the format, content, and validation of invoices.

Before choosing an OCR solution, consider whether it supports your compliance requirements.

There are many steps in manual invoice processing, including entering data, verifying invoice details, conducting three-way matching (invoice, purchase order, goods receipt note), resolving discrepancies, approving for payment, and more.

Traditionally, these steps require a lot of manual effort and are error-prone.

Automating workflow through OCR can reduce those time-consuming tasks, reduce costs, and increase efficiency when done right.

Here’s the step-by-step guide to effectively implement invoice OCR

Plenty of OCR software providers are in the market. Consider the following factors to choose the right one.

Some of the best invoicing OCR software providers are:

After selecting your most-suited OCR software provider, the next step is to set up the system. Follow the specific instructions for your software and hardware to complete this process.

To make the most of OCR systems, users need adequate know-how.

OCR itself requires human oversight, so proper training is necessary to understand and utilize the functions of the OCR system effectively.

OCR software comes with a manual and some providers offer training on its product. Inquire with your OCR software providers for more information.

OCR output quality depends on high-quality input, in this case, the original invoice images and documents.

Some of the best practices to ensure high-quality input for OCR are:

Regularly check your OCR software settings, like the resolution setting or language setting, to ensure accurate results and improve the quality of text recognition.

OCR technology is not flawless.

Errors include misreading letters, skipping over letters, or combining text from adjacent columns. Some of these errors are due to poor input quality, while others are simply from limitations of the OCR technology itself.

That said, a good OCR technology should have a 98-99% accuracy rate.

Despite achieving 99% accuracy, documents containing sensitive information like invoices require review by humans.

💡 Tip: Opt for OCR technology that integrates AI and deep learning models to enhance accuracy.

The OCR recognition process is not very accurate when processing low-quality images, whether they be blurry, distorted, wrinkled, torn, faded, aged, smudged, low resolution, or low contrast images.

💡 Tip: Scan the invoices at 300 DPI minimum, keep the brightness level 50% and use RGB mode when dealing with faded documents.

Invoice OCR systems may lack support for different languages or character sets.

Factors such as small fonts, multiple fonts, varying text sizes, or mixed languages can confuse the system and cause errors in data extraction.

💡 Tip: Consider communicating with partners to standardise document sizes, fonts, and formatting.

OCR invoicing can be a worthwhile investment if you deal with huge amounts of invoices. Choose an OCR service provider with a high accuracy rate, industry relevance, and easy integration with your accounting system or invoicing software for maximum effectiveness.

Statrys Invoicing Software

Start using OCR to upload and save invoice details. Try how easy it is today!